Optimize Your Trading Setup with FxMath Trade Fusion AI

Configuring Auto Trading mode with the FxMath Trade Fusion AI Optimizer is quick and simple. Follow these steps to achieve a tailored setup:

- Copy and paste FxMath_Trade_Fusion_AI_Optimizer.ex5 into your MT5 Experts folder

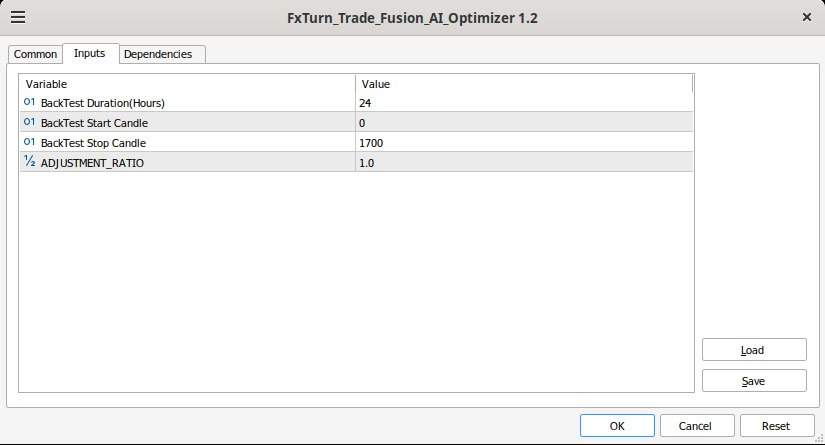

- Define your preferred cut_profit and cut_loss values

- Press the button to start the optimization process

- The optimizer will analyze your broker’s trading conditions to determine the best settings and trading hours

This tool is completely free and does not require a license. With just a few clicks, you’ll have an optimized setup tailored to your trading needs!

Default Settings

The default settings of the FxMath Trade Fusion AI Optimizer are configured for 1,700 hourly candles, equivalent to approximately 3.5 months of trading data.

Example Setup

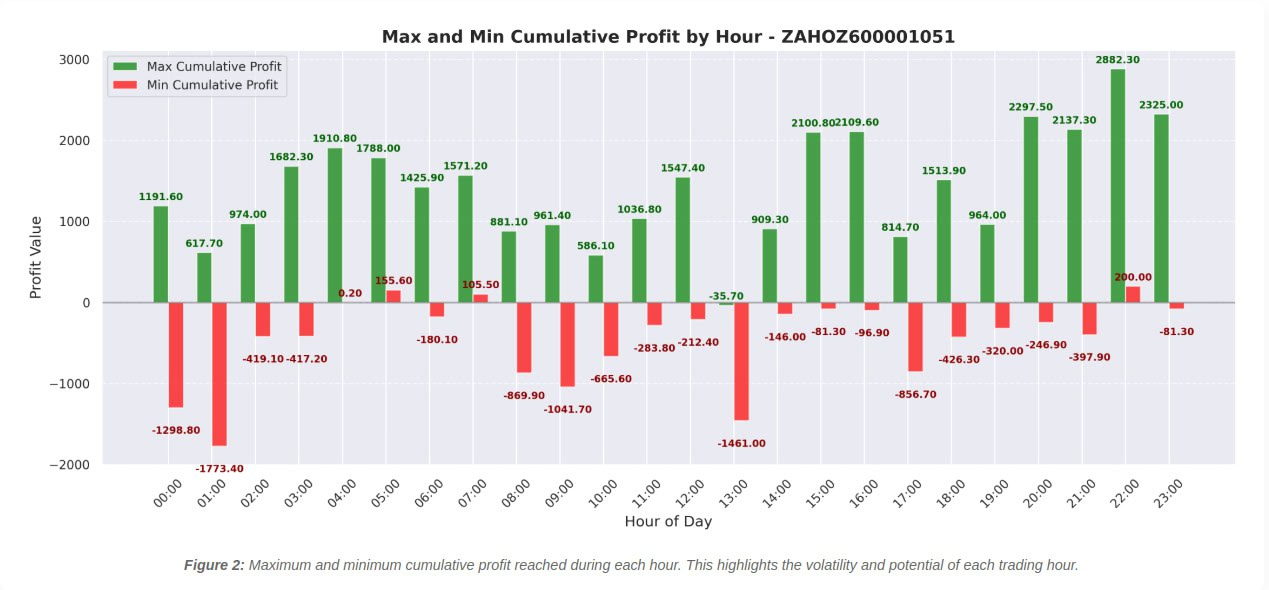

If you set cut_loss and cut_profit to 200, this represents 200 pips. Once the analysis is complete, the optimizer opens a browser page displaying detailed data along with various charts to help visualize the results.

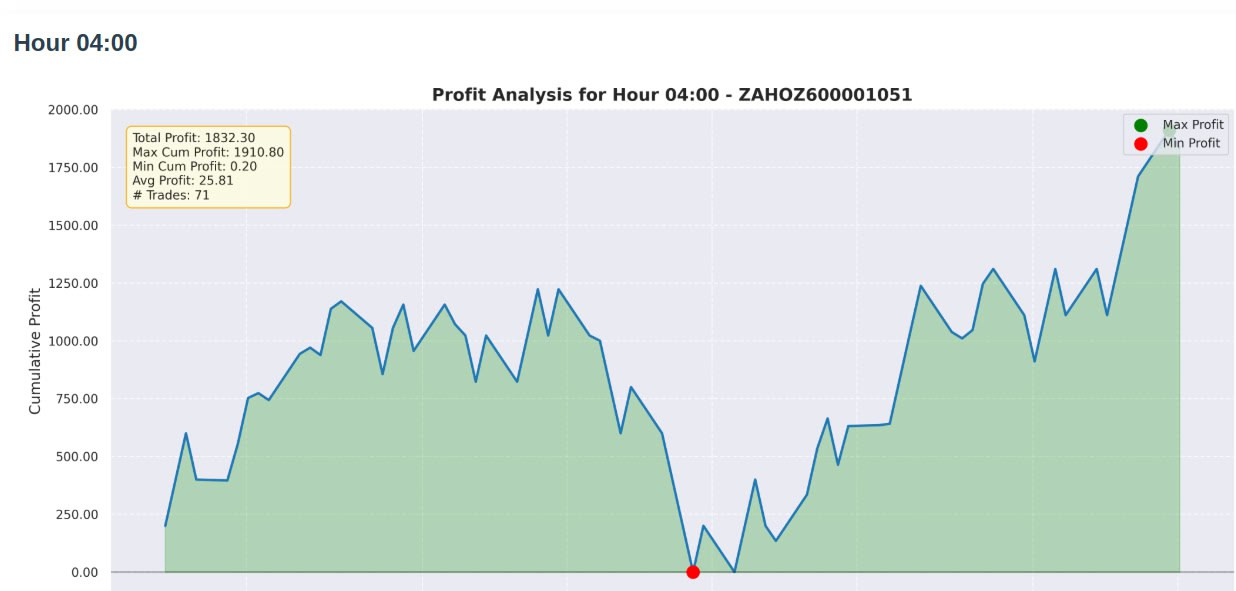

My broker’s analysis reveals certain profitable hours, allowing us to select the best trading periods. For smoother profit curves with minimal drawdown (DD), I prefer hours that consistently show profitability with few losing baskets. Recently, 4:00 AM and 15:00 PM have yielded significantly better profits.

Recommended Settings

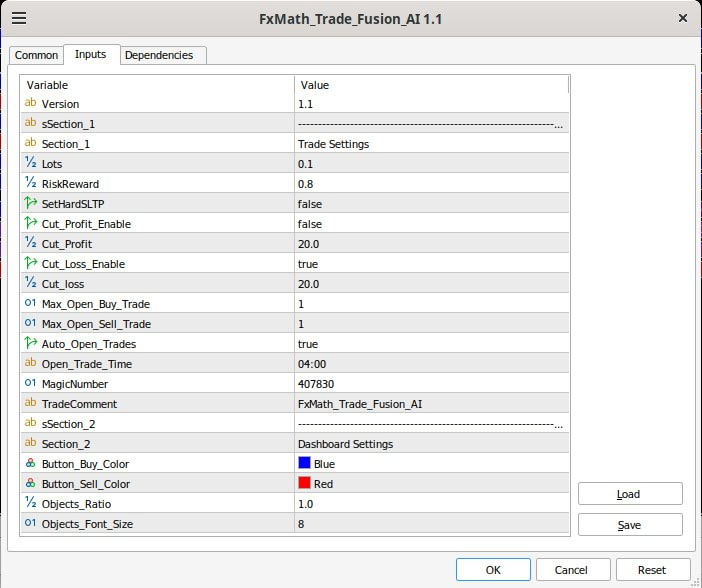

For a trading lot size of 0.01, use the following setup:

- Set cut_profit and cut_loss to 20

- Enable the Auto_Open_Trade function

- Set open_trade_time to 4:00 AM in your FxMath_Trade_Fusion_AI EA

- Keep MT5 running 24/5 for smooth operation

For optimal performance and reliability, consider running it on a VPS.

Adjusting for Lot Sizes

For different lot sizes, adjust cut_profit and cut_loss values accordingly:

- 0.1 lot: Set cut_profit and cut_loss to 200

- 0.05 lot: Set cut_profit and cut_loss to 100

Adjust values proportionally based on your preferred lot size to optimize performance.

Risk Management and Performance

With this strategy, your account is protected as each trade basket manages expected losses effectively. By utilizing a basket of trades, we control drawdown (DD) and ensure balanced risk management. This method adapts to various market conditions—whether trending, volatile, ranging, or moving sideways—generating profits faster and more efficient.

SPECIAL OFFER

Get a 24-month license for only $199 when you pay with crypto!