Brief Introduction:

The Elliott Wave Principle, or Elliott wave theory, is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology and price levels, such as highs and lows, by looking for patterns in prices.

Ralph Nelson Elliott (1871–1948), an American accountant, developed a model for the underlying social principles of financial markets by studying their price movements and developed a set of analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call Elliott waves, or simply waves. Elliott published his theory of market behavior in the book The Wave Principle in 1938, summarized it in a series of articles in Financial World magazine in 1939, and covered it most comprehensively in his final major work, Nature’s Laws: The Secret of the Universe in 1946. Elliott stated that “because man is subject to rhythmical procedure, calculations having to do with his activities can be projected far into the future with a justification and certainty heretofore unattainable.”

In this series of articles, I will write about Elliott Waves.

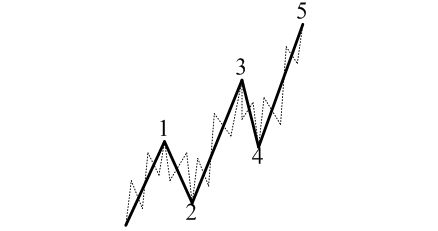

Leading diagonals

Wave rules:

- The end of the second wave never comes over the beginning of the first wave;

- The third wave always extends beyond the top of the first wave;

- The end of the fourth wave always comes over the top of the first wave, but it never goes over the beginning of the third wave;

- The third wave is never the shortest of all the acting waves;

- The third wave is always an impulse;

- The first wave may be either an impulse or a leading diagonal;

- The fifth wave can be either an impulse or a diagonal;

- The second wave could take the form of any corrective wave except a triangle;

- The fourth wave could take the form of any correctional wave;

Regards,

FxMath Financial Solution